/The One Money Mistake You Should Avoid as an Amazon Seller

The One Money Mistake You Should Avoid as an Amazon Seller

We asked successful Amazon sellers one simple question:

“What money mistake will you never make again?”

We expected to receive a wide range of responses, but instead found a glaring pattern and a single mistake every seller should avoid.

Time and time again, the sellers described their biggest mistake was…

Investing everything in one ASIN or inventory source

You’ve heard the old adage: “don’t put all of your eggs in one basket” — and this traditional wisdom is true, especially if you haven’t done your homework on the ASIN in question.

In the words of Scott Zilke, the “Bearded Picker” who has $3 Million of lifetime Amazon sales under his belt:

“I will not make a large inventory purchase without evaluating the type of sellers on the listing. In 2019, the booty shakin' llama was going to be a homerun in the 4th quarter. But, I underestimated how many dropshippers were on the listing, and with their endless supply of "inventory", they bottomed out the price for 5 months straight. I keep one of the llamas that was returned on my desk as a reminder.”

The Bearded Picker

Jimmy Smith, who runs a 7-figure Amazon business and posts weekly educational videos on YouTube, also notes that:

“Going really deep on products before vetting their actual sales velocity has been detrimental in the past if I couldn’t sell through them for some reason.

I love the inch deep and mile wide approach to arbitrage before moving onto bigger orders with wholesale or private label products. Never sink thousands of dollars into products you haven’t sold before.”

Jimmy Smith

Zilke and Smith aren’t the only ones who had something to say about going “all in” on one source of inventory. Chris Grant, Amazon seller of 9+ years who has led thousands of students in scaling their online arbitrage businesses, adds:

“When I was new to reselling I thought that I found a no-brainer deal. It was an entire truckload of inventory that was advertised as shelf pulls and some returned items from Kmart.”

Chris Grant

Grant went on to pool $5k of cash to cover the inventory, storage, and a forklift. Shortly after the inventory arrived and he began unpacking it, he realized his mistake.

“I bought garbage. Most of it had significant damage. The items that could be resold were mostly low dollar items that would not make a significant dent in the money spent to purchase all of this inventory trash. Eventually I was able to recoup about 1/6th of what I paid by selling everything to a flea market vendor in bulk. The lesson I took away from this was that I should never take that large of a bet on one source of inventory.’

On what he could have done better, Grant adds:

“Had I been smart, I would have spent $1,000 to test and the remaining $4,000 on other opportunities…I would prefer to treat my inventory like an index fund rather than a Wall Street Bets stock tip. I can protect my downside risk by being more diversified while still being able to participate in the upside (profits) of an inventory business.”

Long story short: if it seems too good to be true, it probably is. Avoid jumping into a listing without all the context. Instead, diversify risk across multiple listings while you learn the landscape.

Otherwise, you may find yourself staring into the eyes of a returned booty shakin’ llama.

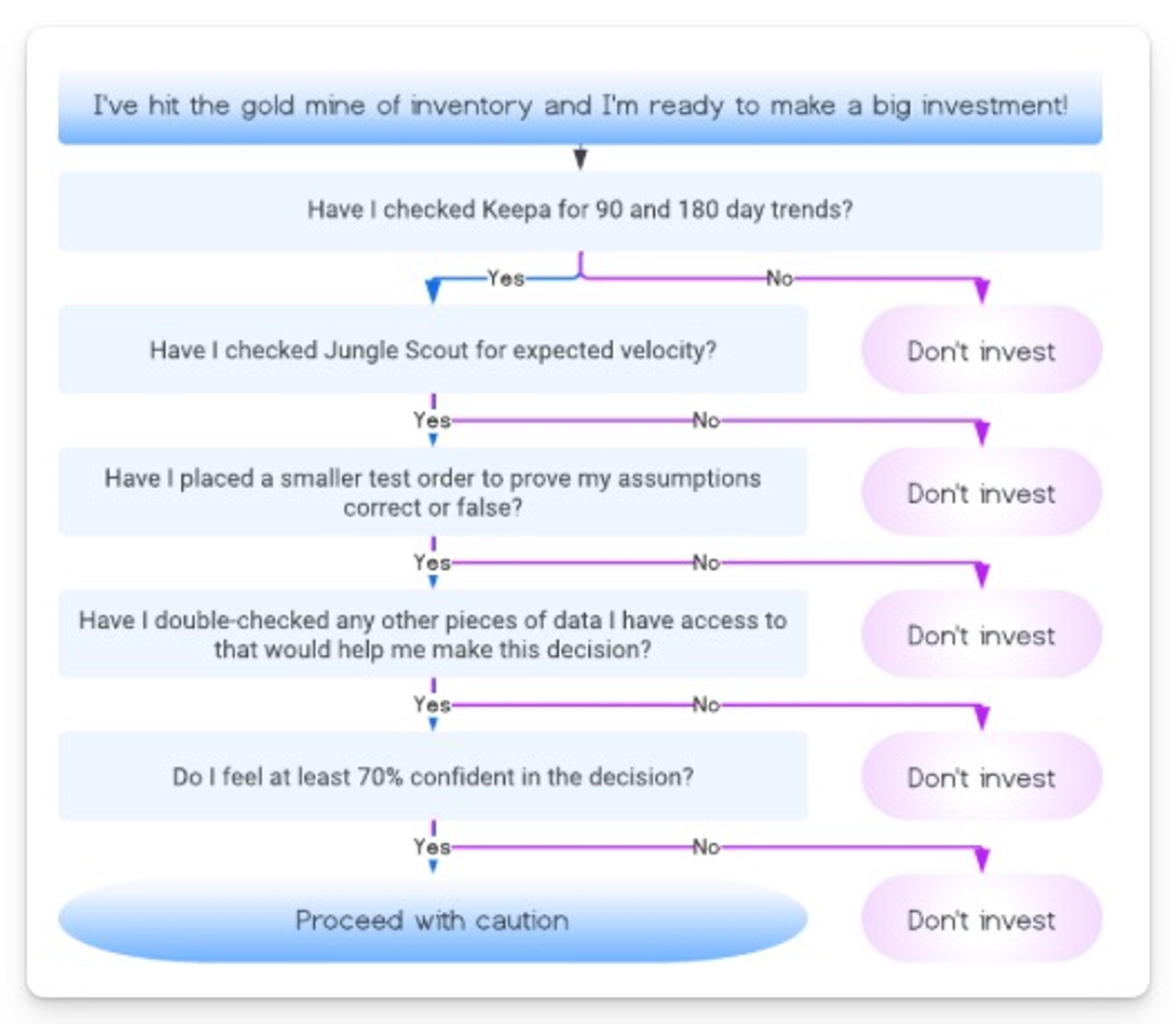

Ready to make a big inventory purchase? Take a moment to slow down and work through our checklist / decision flow: