If you've been a seller for even a few hours you'll have heard the term "price tanking". Price tanking is when a seller begins to lower the price of a listing, which then creates a downward spiral. This quickly removes any profitability from the listing.

Why would sellers lower their price in the first place? There's a few different reasons, but the main two are:

- They've held the product too long and need to recover capital

- They want more time in the buy box to increase sales

Seller Psychology: How Sellers Think

Keep in mind that every competitor is in a different lifecycle than you are with their inventory. Every seller is conservative and focused on profitability when they first come in stock. As time goes on, they become less conservative and care less about profits. This makes a lot of sense as the opportunity cost increases and long-term storage fees begin.

In fact, this is a great strategy to consider on replens or wholesale-based products.

The opportunity cost is an area many sellers struggle with as a concept. Holding slow-selling items too long costs you. Selling them for less now could let you reinvest the capital and profits into more profitable and better products. You're trading a C product for an A product.

Additionally, every seller has different buy costs. It's sometimes worth lowering the price to increase the demand of a product. You may find that you can lower the price by $2 but increase the demand by 30%, which would yield more total profits. It's your classic supply and demand curve from economics.

Using Maven to Avoid Price Tanking

While lowered prices are out of your control, how you respond is.

The difficulty is handling these cases in real-time across potentially thousands of listings. That's where you'll want to lean on software to solve the problem. Let's get to know Maven, our AI model better.

Maven is designed to find the balance between sales velocity and profitability. We call this the optimal price. The optimal price changes with your competition and the listing attributes. The demand can increase or lower, for example.

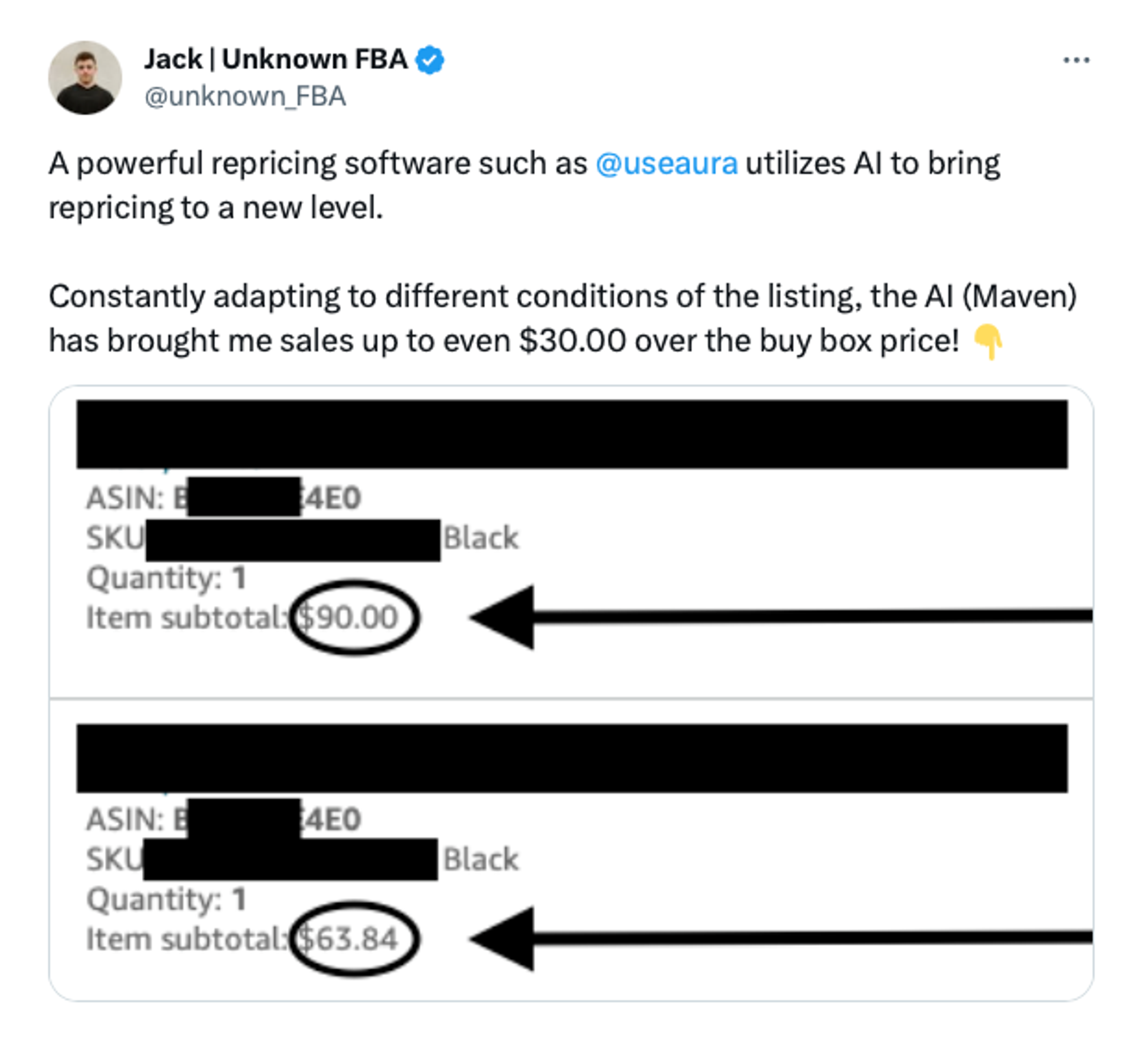

Maven is able to intelligently increase the buy box price. This alone can help negate price tanking issues. Additionally, it knows how each of your competitors on a listing will behave. Using that knowledge allows it to avoid triggering price tanking.

In fact, it's not uncommon to see sales above where the buy box has been.

While there are a number of manual methods to avoid price tanking, using AI is the most effective.

Wrapping up

By leveraging Maven's AI capabilities, you're not just reacting to the market's ebbs and flows—you're anticipating them, staying one step ahead of price tanking and protecting your profits.

Remember, each decision to hold or sell impacts your bottom line (opportunity cost). Maven helps to automate that for you in real-time across all of your listings.