When we released Maven, expectations were high—it was engineered to perform.

The results, however, exceeded our high expectations.

The process began with alpha testing—rigorous internal testing to ensure it worked. Following this, Maven underwent beta testing with a handpicked set of users to iron out any kinks. Only then did we feel confident to launch it publicly. The subsequent outcome was nothing short of remarkable.

The larger user base shed light on a phenomenon that genuinely surprised us, in the best way.

But first, let me explain how Maven operates. It's designed to find a delicate balance between sales velocity and profitability—these are the two levers at play. Consider a liquidation strategy; it typically favors velocity over profitability. Maven, however, aims for what we term the Optimal Price—a dynamic price that adapts in real-time to many variables.

Evaluating the success of any repricing strategy traditionally hinged on metrics like total sales or time in the buy box. These metrics, though straightforward, are overly simplistic. Instead, we adopted a broader perspective.

We chose to measure success by the duration our listings stayed at the Optimal Price, ideally while securing the buy box.

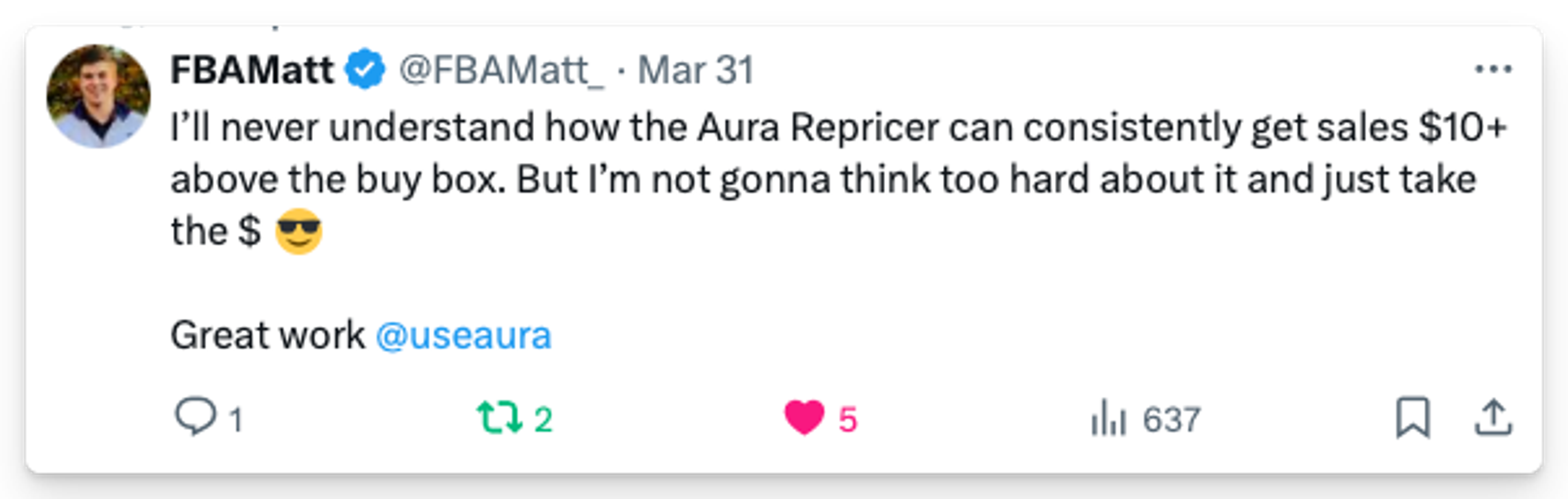

Interestingly, Maven began raising the price above the buy box. Initially, this seemed counterintuitive. Yet, it resulted in sales at these higher prices.

What we hadn't anticipated was the frequency of this happening for users—leading to more profitable sales. This insight was not just a testament to Maven's efficacy but also the paradigm shift in how we perceive and measure success for repricing.

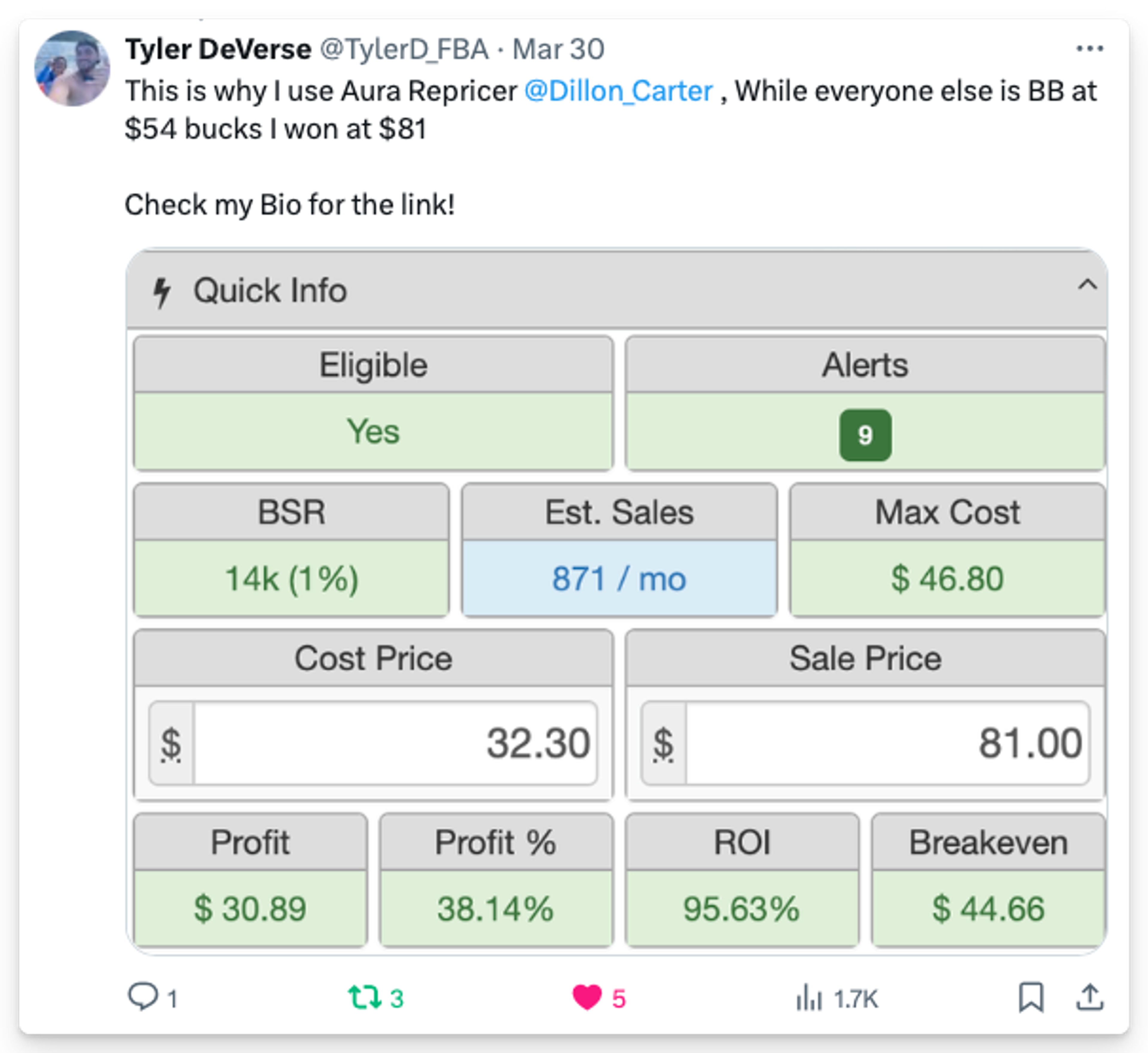

There's a reason why our users are fanatics about Aura. Here's a couple of those users...

Not a day goes by where our team doesn't see this first hand or hear about it from our customers on different platforms.