/Amazon Seller Financing in 2024: The Ultimate Guide to Loans & Credit Lines

Amazon Seller Financing in 2024: The Ultimate Guide to Loans & Credit Lines

Are you an Amazon seller looking to take your business to the next level in 2024?

Access to capital is crucial for purchasing inventory, expanding your product line, and scaling your operations. But navigating the world of Amazon seller financing can be overwhelming.

That's where this ultimate guide comes in.

We'll break down the best loans and credit lines available for Amazon sellers, so you can secure the funding you need to grow your business with confidence.

From fast and easy options like Viably to flexible solutions tailored for FBA sellers, we've got you covered. Plus, we'll share expert tips on qualifying for financing, comparing rates and terms, and avoiding common mistakes.

Ready to supercharge your Amazon business? Let's dive in.

Amazon Seller Loans: Boost Your Business Growth

As an Amazon seller, you know that having access to capital is crucial for maintaining a healthy cash flow and growing your business. Amazon seller loans provide a solution to this challenge, offering quick access to funds that can be used for inventory purchases, marketing campaigns, and expansion efforts.

Overview of Amazon seller loans

Amazon seller loans are short-term loans designed specifically for Amazon sellers. These loans help sellers overcome cash flow challenges and take advantage of growth opportunities. By securing an Amazon seller loan, you can purchase inventory, invest in marketing, and expand your business without worrying about immediate cash constraints.

Benefits of Amazon seller loans

One of the main advantages of Amazon seller loans is the quick access to capital. Unlike traditional bank loans, which can take weeks or even months to process, Amazon seller loans can be approved and funded within a matter of days. This fast turnaround time allows you to seize opportunities as they arise and keep your business running smoothly.

Another benefit of Amazon seller loans is the flexible repayment terms. Many lenders offer customizable repayment plans that align with your business's cash flow, making it easier to manage your finances and avoid overextending yourself.

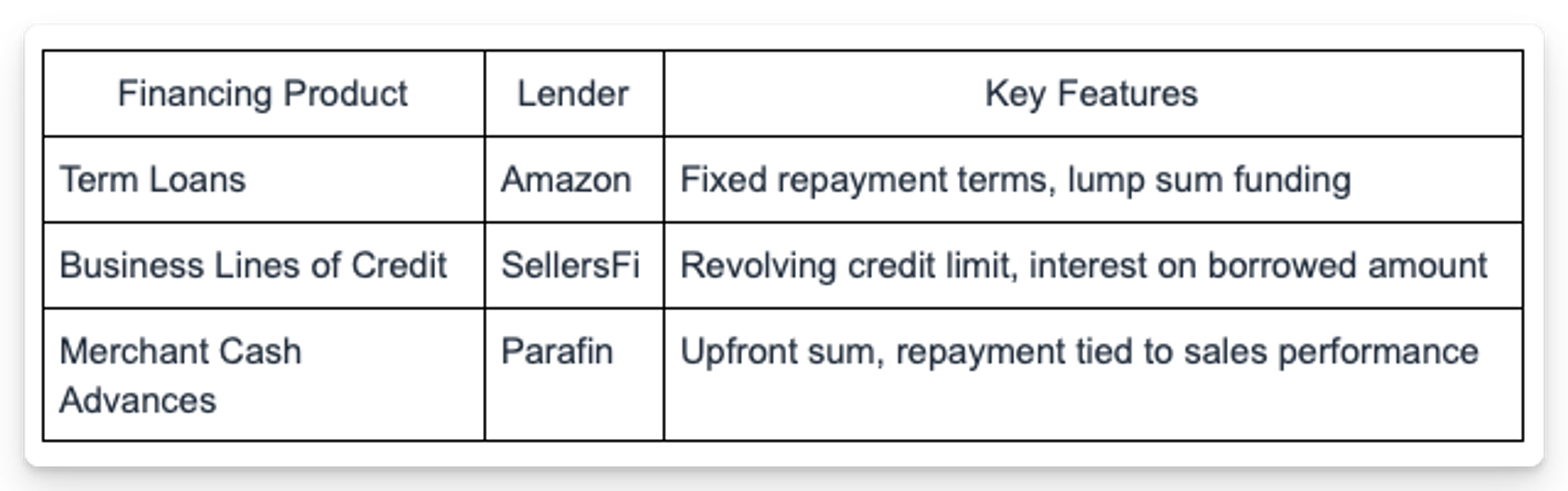

Types of Amazon seller loans

There are several types of Amazon seller loans available, each with its own unique features and benefits. Term loans provide a lump sum of cash that you repay over a set period, typically ranging from a few months to a few years. Lines of credit, on the other hand, offer a revolving credit limit that you can draw from as needed, only paying interest on the amount you borrow. Merchant cash advances provide an upfront sum in exchange for a percentage of your future sales, making repayment more flexible and tied to your business's performance.

When it comes to financing options accepted by Amazon, the platform does not directly provide loans to sellers. However, there are many third-party lenders that specialize in providing financing solutions tailored to the needs of Amazon sellers. These lenders often have a deep understanding of the e-commerce landscape and can offer loans based on your sales history, credit score, and other factors.

To qualify for an Amazon seller loan, you typically need to have a professional selling account, a history of selling on Amazon for at least one year, and a minimum of $10,000 in monthly sales. Additionally, you must have a good credit score and a positive customer feedback rating.

By securing an Amazon seller loan, you can boost your business growth, maintain a healthy cash flow, and take your e-commerce venture to the next level. In the following section, we'll explore how to qualify for these loans and what you need to know to make an informed decision.

How to Qualify for Amazon Seller Loans

- Learn the minimum requirements to be eligible for an Amazon seller loan

- Discover the documents you need to submit for a successful loan application

To secure an Amazon seller loan, you must meet certain criteria and provide specific documentation. This section will guide you through the qualification process step by step.

Minimum requirements for Amazon sellers

Amazon seller account in good standing

To be eligible for an Amazon seller loan, your seller account must be in good standing. This means:

- Your account has been active for at least 12 months

- You have a positive seller feedback rating (ideally above 90%)

- You have no outstanding policy violations or unresolved issues with Amazon

Maintaining a strong seller performance is crucial to qualify for financing. Consistently deliver high-quality products, provide excellent customer service, and adhere to Amazon's selling policies.

Minimum sales volume and revenue

Amazon typically requires sellers to have a minimum sales volume and revenue to be considered for a loan. While the exact thresholds may vary, you generally need:

- At least $10,000 in monthly sales for the past 3-6 months

- A minimum of $50,000 in annual revenue

These requirements demonstrate that your business has a stable sales history and the potential for growth. Focus on optimizing your product listings, pricing, and marketing strategies to boost your sales and revenue.

Documentation needed for loan application

When applying for an Amazon seller loan, you'll need to provide various documents to verify your business information and financials. Here's what you should prepare:

- Business registration and tax documents

- Articles of incorporation or business license

- Federal tax ID number (EIN)

- State tax ID number (if applicable)

- Personal identification

- Government-issued ID (e.g., driver's license or passport)

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Bank statements and financial records

- Business bank account statements for the past 3-6 months

- Income statement and balance sheet

- Cash flow statement

- Tax returns for the past 1-2 years

- Amazon seller account information

- Seller Central login credentials

- Sales and revenue reports

- Inventory and supplier information

Gathering these documents beforehand will streamline the loan application process. Ensure that all information is accurate, up-to-date, and easily accessible.

By meeting the minimum requirements and providing the necessary documentation, you'll be well-positioned to qualify for an Amazon seller loan and take your business to new heights.

Amazon Seller Credit Lines: Flexible Funding for Your Business

Amazon seller credit lines provide a flexible funding option for businesses looking to manage their cash flow and cover ongoing expenses. Unlike traditional loans, credit lines allow sellers to borrow up to a pre-approved limit and only pay interest on the amount used.

Understanding Amazon seller credit lines

Credit lines work as revolving credit, giving Amazon sellers access to funds they can draw from as needed. This type of financing is particularly useful for covering recurring costs such as inventory purchases, advertising campaigns, and operational expenses. With a credit line, sellers can borrow up to their approved limit without having to reapply for funds each time.

Advantages of credit lines for Amazon sellers

One of the main benefits of Amazon seller credit lines is the flexibility they offer. Sellers can access funds when they need them and only pay interest on the amount borrowed. This makes credit lines an attractive option for managing seasonal inventory fluctuations and taking advantage of growth opportunities.

Key Advantages of Credit Lines for Amazon Sellers

- Flexibility: Access funds as needed and only pay interest on the borrowed amount.

- Adaptable Repayment: No fixed repayment schedule, allowing repayment to adapt to the business's cash flow.

- Cost-Effective: Often have lower interest rates than other forms of short-term financing.

Compared to traditional loans, credit lines don't have a fixed repayment schedule. This allows sellers to adapt their repayment to their business's cash flow. Additionally, credit lines often have lower interest rates than other forms of short-term financing, making them a cost-effective choice for both short-term and long-term needs.

Comparing credit lines to traditional loans

When considering financing options, it's essential to understand the differences between credit lines and traditional loans. Here's a quick comparison:

- Repayment Schedule: Credit lines have no fixed repayment schedule, while loans have set monthly payments.

- Interest Rates: Credit lines may offer lower interest rates than short-term loans.

- Financing Needs: Credit lines are suitable for both short-term and long-term needs, while loans are typically better for long-term financing.

To answer the question, "Does Amazon business offer financing?" - while Amazon itself doesn't provide financing directly, there are many third-party lenders that specialize in offering credit lines and loans to Amazon sellers. These lenders understand the unique needs of e-commerce businesses and can provide tailored financing solutions.

Securing an Amazon Seller Credit Line

- Understand the eligibility criteria for Amazon seller credit lines

- Learn the step-by-step process for applying and securing funding

- Discover the documents and information required for a successful application

When you're ready to apply for an Amazon seller credit line, it's crucial to understand the eligibility criteria and application process. By knowing what lenders look for and gathering the necessary documents, you can increase your chances of securing the funding your business needs.

Eligibility criteria for credit lines

To qualify for an Amazon seller credit line, you typically need to meet the following requirements:

- Active Amazon seller account: You must have an active Amazon seller account in good standing, with a history of consistent sales.

- Minimum monthly revenue: Lenders usually require a minimum monthly revenue, often ranging from $5,000 to $10,000 or more, depending on the lender.

- Time in business: Most lenders prefer businesses that have been operating for at least six months to a year, as this demonstrates stability and potential for growth.

- Credit score: While some lenders may not have strict credit score requirements, having a good personal or business credit score can improve your chances of approval and help secure better terms.

- No significant negative balances or chargebacks: Lenders will review your Amazon seller account to ensure you don't have substantial negative balances or excessive chargebacks, which could indicate poor management or customer satisfaction issues.

Application process and requirements

Once you've determined that you meet the eligibility criteria, you can begin the application process. Here's a step-by-step guide:

Step 1: Gather necessary documents

Before applying, collect the following documents and information:

- Business identification, such as your Employer Identification Number (EIN) or Social Security Number (SSN) for sole proprietorships

- Personal and business bank statements, typically for the past three to six months

- Amazon seller account information, including your seller ID and sales history

- Personal identification, such as a driver's license or passport

- Business financial statements, including profit and loss statements and balance sheets, if applicable

Step 2: Research and compare lenders

Research various lenders that offer Amazon seller credit lines, comparing their eligibility requirements, interest rates, fees, and repayment terms. Consider factors such as the lender's reputation, customer reviews, and the level of customer support they provide.

Step 3: Submit your application

Once you've chosen a lender, complete their online application form, providing the requested information and documents. Most applications can be completed within 15-30 minutes.

Step 4: Wait for approval and funding

After submitting your application, the lender will review your information and make a decision, typically within one to three business days. If approved, you'll receive an offer detailing the credit line amount, interest rate, and repayment terms. Upon accepting the offer, the funds will be deposited into your business bank account, usually within one to two business days.

By understanding the eligibility criteria and following the application process step-by-step, you can increase your chances of securing an Amazon seller credit line to support your business's growth and success.

Top Amazon Seller Funding Options in 2024

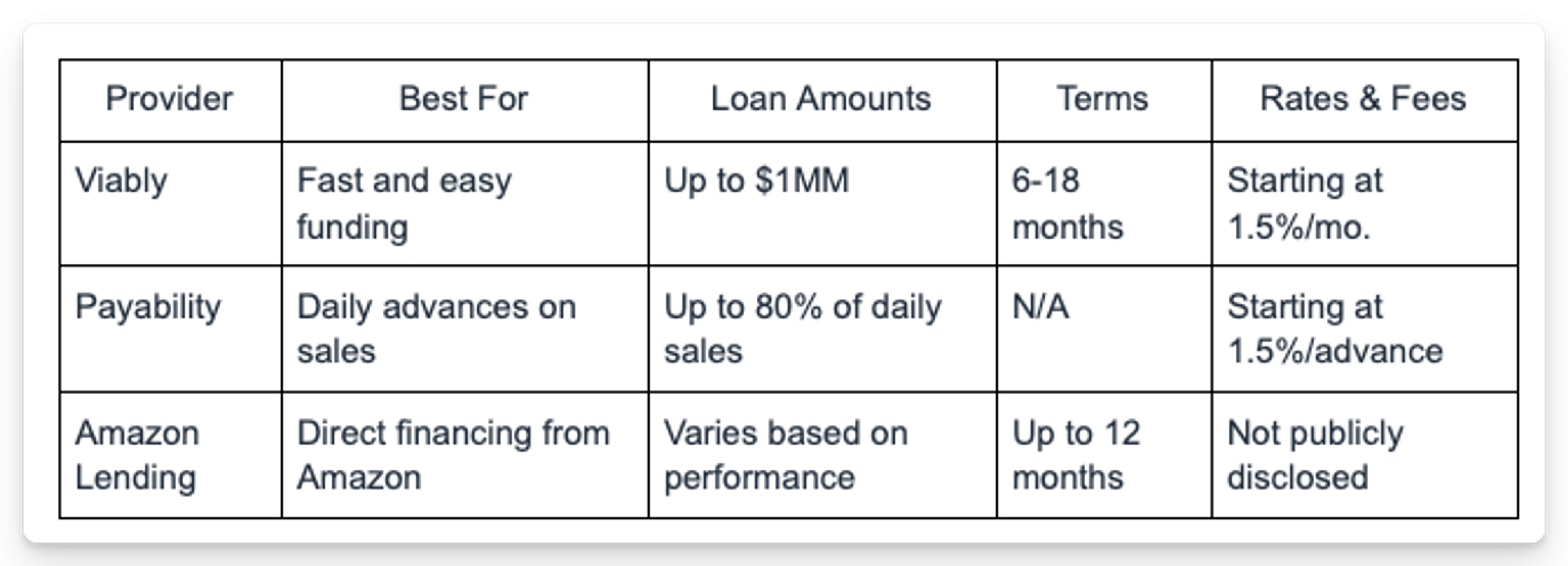

When it comes to financing your Amazon business, there are several options available. In this section, we'll compare the top Amazon seller funding options in 2024, including Viably, Payability, and Amazon Lending. Each of these providers offers unique benefits and terms, so it's essential to understand which one best suits your business needs.

Viably: Best for Fast and Easy Funding

Viably is a popular choice among Amazon sellers due to its streamlined application process and quick funding. Here's what you need to know:

Overview of Viably's financing solutions

Viably offers two main financing products for eCommerce and Amazon sellers:

Viably Cash Advance:

- Daily cash payout of up to 80% of the previous day's sales

- Designed to provide quicker access to sales revenue to fund growth

- Best suited for starting sellers

Viably Growth Capital:

- Funding amounts up to $1,000,000

- Intended to provide capital for scaling eCommerce businesses

- Connects with seller's tools to forecast cash flow needs

Benefits for Amazon Sellers:

- Access to funding to grow inventory, marketing, and operations

- Visibility into performance metrics and cash flow projections

- Automated forecasting to plan capital needs

- Personalized funding offers based on business data

Pricing and Terms:

Viably does not explicitly state pricing details, but mentions:

- Up to $1,000,000 in growth capital funding

- Daily payouts for the cash advance product

Viably emphasizes providing tailored funding solutions after connecting to the seller's accounts and analyzing their business data.

Payability: Best for Daily Advances on Amazon Sales

Payability offers a unique funding solution for Amazon sellers by providing daily advances on their sales. This can help improve cash flow and allow sellers to reinvest in their business more quickly.

[H4] How Payability works for Amazon sellers

Payability integrates directly with your Amazon seller account and advances up to 80% of your daily sales. The remaining balance, minus fees, is paid out according to Amazon's regular payment schedule.

Advantages of daily advances

- Improved cash flow

- Ability to reinvest in inventory and growth more quickly

- No credit checks or lengthy application process

Pricing and fees

- Advances up to 80% of daily Amazon sales

- Fees starting at 1.5% per advance

- No long-term contracts or hidden fees

Amazon Lending: Best for Direct Financing from Amazon

Amazon Lending is a financing program offered directly by Amazon to eligible sellers. This can be a convenient option for those who prefer to work directly with Amazon.

Overview of Amazon Lending program

Amazon Lending offers term loans to qualified sellers to help them grow their businesses. Loan offers are based on a seller's performance and are invitation-only.

Benefits of borrowing directly from Amazon

- Convenient financing option for Amazon sellers

- Loan offers based on seller performance

- Funds can be used for various business purposes

Loan terms and eligibility

- Loan amounts vary based on seller performance

- Terms of up to 12 months

- Invitation-only program

In our opinion, Viably stands out as the best overall option for Amazon seller financing in 2024. Their fast and easy application process, coupled with competitive rates and flexible terms, make them an attractive choice for many sellers. However, Payability's daily advance feature can be a game-changer for those looking to improve cash flow, and Amazon Lending remains a convenient option for eligible sellers.

Understanding Amazon Seller Financing Terms and Rates

- Familiarize yourself with common financing terms like APR, factor rate, and origination fee

- Interest rates and fees are influenced by factors such as loan amount, credit history, and seller performance

- Compare financing options by calculating total borrowing costs and considering repayment flexibility

Common financing terms for Amazon sellers

When seeking financing for your Amazon business, it's crucial to understand the terms lenders use. Annual percentage rate (APR) represents the yearly cost of borrowing, including interest and fees, expressed as a percentage. APR is calculated as an interest rate, taking into account monthly payments and fees, and represents the annual rate of interest paid on investments without considering compounding within that year. Factor rate, more common in invoice financing or merchant cash advances, is a multiplier applied to the borrowed amount to determine the total repayment. Origination fee is a one-time charge for processing a new loan, often a percentage of the loan amount.

APR vs. factor rate

While APR is more straightforward, factor rates can be confusing. To compare offers, convert the factor rate to an approximate APR. For example, a factor rate of 1.2 on a 6-month loan is roughly equivalent to a 40% APR. Keep in mind that factor rates don't account for the loan term, so shorter terms result in higher effective APRs. Factor rates typically range from 1.1 to 1.5, varying based on the provider’s assessment of your business.

Factors affecting interest rates and fees

Interest rates and fees for Amazon seller financing vary based on several factors:

- Loan amount and repayment term: Larger loans and longer terms often have lower rates, as the lender's risk is spread out over time.

- Business and personal credit history: Strong credit scores demonstrate financial responsibility and can lead to better rates.

- Amazon seller account performance: Lenders may assess your account health, sales volume, and feedback ratings to determine risk and rates.

Tips for comparing financing options

When shopping for Amazon seller financing, follow these tips to make informed decisions:

- Calculate the total cost of borrowing, including interest and fees, over the life of the loan. This helps you compare offers with different terms and rate structures.

- Consider the repayment structure and flexibility. Some lenders require daily or weekly payments, while others offer monthly installments. Look for options that align with your cash flow.

- Read reviews and compare lender reputations. Check trusted sources like TrustPilot or the Better Business Bureau to gauge customer experiences and service quality.

What is the interest rate for Amazon business loans?

Interest rates for Amazon business loans can range from 6% to over 20%, depending on the lender and factors discussed earlier. Amazon's own lending program, Amazon Lending, offers rates between 6-16%, but not all sellers are eligible. Alternative lenders may have higher rates but more flexible qualification criteria.

Ultimately, the best financing option depends on your unique needs and qualifications. By understanding key terms, factors affecting rates, and comparison strategies, you can make informed decisions to grow your Amazon business.

Financing for Amazon FBA Sellers: Unique Funding Needs

- Amazon FBA sellers have specific financing requirements due to their business model

- Upfront costs, FBA fees, and seasonal demands create unique funding needs

- Tailored financing options like inventory financing and merchant cash advances can help

Understanding the Amazon FBA Business Model

Amazon's Fulfillment by Amazon (FBA) program has revolutionized e-commerce, allowing sellers to outsource inventory management and shipping to Amazon's warehouses. This model offers several advantages, such as access to Prime customers, faster delivery times, and potential for higher profit margins. However, it also comes with unique costs and challenges that sellers must navigate.

Fulfillment by Amazon Program

When a seller enrolls in the FBA program, they send their inventory to Amazon's fulfillment centers. Amazon then stores, picks, packs, and ships the products to customers when orders are placed. This process relieves sellers of the burden of managing inventory and shipping logistics, allowing them to focus on other aspects of their business, such as product sourcing and marketing.

Inventory Management and Storage Fees

While FBA offers convenience, it also comes with associated costs. Amazon charges FBA sellers for inventory storage and fulfillment fees. Storage fees are based on the amount of space a seller's products occupy in Amazon's warehouses and can vary depending on the time of year. Fulfillment fees cover the costs of picking, packing, and shipping orders and are charged per unit sold. For example, the fulfillment cost per unit includes picking and packing orders, shipping and handling, customer service, and product returns, with costs based on the weights and dimensions of products.

Potential for Higher Profit Margins

Despite the additional fees, FBA sellers often enjoy higher profit margins compared to sellers who handle fulfillment themselves. This is because FBA products are eligible for Prime shipping, which can lead to increased sales and customer trust. Additionally, outsourcing fulfillment allows sellers to save on the costs of maintaining their own warehouse space and staff.

Specific Financing Needs of FBA Sellers

The unique aspects of the FBA business model create specific financing needs for sellers. These needs revolve around funding inventory purchases, covering FBA fees, and managing cash flow during product launches and seasonal demands.

Upfront Costs for Inventory Purchases

One of the most significant expenses for FBA sellers is purchasing inventory. Sellers must invest in products upfront before they can generate sales revenue. This can tie up a substantial amount of working capital, especially for sellers looking to scale their business or expand into new product lines.

Funding for FBA Fees and Storage Costs

In addition to inventory costs, FBA sellers must also budget for Amazon's fulfillment and storage fees. These fees can add up quickly, particularly for sellers with large inventories or slow-moving products. For instance, storage fees are charged monthly based on the daily average volume (measured in cubic feet) for the space occupied by inventory in Amazon fulfillment centers. Financing can help sellers manage these costs and maintain a healthy cash flow.

Financing for Product Launches and Seasonal Demands

Launching new products or preparing for peak selling seasons like the holidays often requires significant investments in inventory. Sellers may need extra funding to purchase additional stock to meet anticipated demand. Without adequate financing, sellers risk running out of inventory and missing out on potential sales.

Financing Options Tailored for FBA Sellers

To address these unique funding needs, several financing options have emerged specifically tailored for FBA sellers. These include inventory financing, merchant cash advances based on FBA sales, and loans with flexible repayment terms tied to FBA revenue.

Inventory Financing

Inventory financing is a type of loan that uses a seller's inventory as collateral. This allows sellers to borrow money to purchase additional stock without tying up their own working capital. As the inventory sells, the loan is repaid using a portion of the sales revenue.

Merchant Cash Advances Based on FBA Sales

Merchant cash advances (MCAs) provide sellers with a lump sum of capital in exchange for a percentage of their future sales. For FBA sellers, MCAs can be structured based on their Amazon sales history and projections. This type of financing can be useful for sellers who need quick access to funds and have consistent sales volume.

Loans with Flexible Repayment Tied to FBA Revenue

Some lenders offer loans specifically designed for FBA sellers with repayment terms that fluctuate based on the seller's Amazon revenue. This means that during periods of high sales, the seller repays more, while during slower periods, repayment amounts are adjusted accordingly. This flexibility can help sellers manage their cash flow and avoid overextending themselves.

Tips for Amazon FBA Sellers Seeking Financing

- Maintain accurate financial records to increase your chances of securing funding

- Optimize inventory management to reduce costs and improve cash flow

- Leverage sales data to demonstrate your business's potential to lenders

When seeking financing for your Amazon FBA business, it's crucial to be well-prepared and present your business in the best possible light. Chris Shipferling, Managing Partner at Global Wired Advisors, emphasizes the importance of accurate financial records:

"Amazon sellers need to maintain clean and accurate financial statements. This includes keeping track of inventory, sales, and expenses. Lenders want to see that you have a clear understanding of your business's financial health."

Maintain Accurate Financial Records and Projections

As an Amazon FBA seller, one of the most important things you can do to increase your chances of securing financing is to maintain accurate financial records. This includes keeping detailed records of your income, expenses, inventory, and sales.

Having clean, organized financial statements demonstrates to lenders that you have a clear understanding of your business's financial health. It also helps them assess your ability to repay any loans or lines of credit.

Key Financial Records to Maintain

- Income statements

- Balance sheets

- Cash flow statements

- Inventory reports

- Sales reports

In addition to historical financial data, it's also important to create realistic financial projections. This shows lenders that you have a plan for growth and understand the potential challenges and opportunities facing your business.

Optimize FBA Inventory Management to Reduce Costs

Effective inventory management is crucial for Amazon FBA sellers, as it directly impacts your cash flow and profitability. By optimizing your inventory levels, you can reduce storage fees, minimize the risk of stockouts, and improve your overall financial health.

Jason Boyce, Co-Founder and CEO of Avenue7Media, notes:

"Proper inventory management is key to success on Amazon. Sellers need to find the right balance between having enough stock to meet demand and avoiding excess inventory that ties up cash and incurs storage fees."

Consider using tools like RestockPro, InventoryLab, or Forecastly to help you optimize your inventory levels and make data-driven decisions.

Leverage FBA Sales Data to Demonstrate Business Potential

When applying for financing, it's essential to showcase your business's potential for growth. One way to do this is by leveraging your Amazon FBA sales data. By presenting lenders with concrete evidence of your sales history, growth rates, and market share, you can make a compelling case for your business's future success.

Janelle Page, Owner of SellerStrike, advises:

"Amazon sellers should use their sales data to create a strong narrative about their business. Show lenders how you've grown over time, highlight your best-selling products, and demonstrate your market share in your niche."

Choose Lenders with Experience Working with FBA Sellers

When seeking financing for your Amazon FBA business, it's important to work with lenders who understand the unique challenges and opportunities of the e-commerce industry. Look for lenders who have experience working with Amazon sellers and can offer tailored solutions to meet your specific needs.

Stephen Smotherman, Founder of Full-Time FBA, recommends:

"Amazon sellers should seek out lenders who specialize in e-commerce financing. These lenders understand the unique cash flow cycles of FBA businesses and can offer more flexible terms and faster approvals than traditional banks."

Some lenders to consider include Payability, SellersFunding, and Amazon Lending, all of which have experience working with Amazon FBA sellers and offer a range of financing options.

Applying for Amazon Seller Financing: Step-by-Step Guide

- Gather all necessary financial documents before applying

- Compare financing options to find the best fit for your business

- Fill out the application completely and accurately for faster processing

Preparing your business and personal financial documents

Before applying for Amazon seller financing, it's crucial to have all your financial documents in order. This includes both your business and personal financial records. Lenders will want to see a clear picture of your financial health to determine your eligibility and loan terms.

Start by gathering your business financial statements, including your balance sheet, income statement, and cash flow statement. These documents should cover at least the past two years. If you don't have these readily available, work with your accountant or bookkeeper to prepare them.

Next, collect your personal financial documents, such as your tax returns, bank statements, and credit reports. Lenders may also ask for a personal financial statement, which lists your assets, liabilities, and net worth. Having these documents ready will streamline the application process and show lenders that you're prepared and serious about securing financing.

Choosing the right financing option for your needs

With various Amazon seller financing options available, it's essential to choose the one that best fits your business needs and goals. Consider factors such as the loan amount, repayment terms, interest rates, and collateral requirements.

Loan amount and repayment terms

Determine how much money you need to borrow and how long you'll need to pay it back. Some financing options, like term loans, offer larger loan amounts with longer repayment periods, while others, like lines of credit, provide more flexibility with smaller amounts and shorter terms. For example, Amazon Lending offers loan amounts ranging from $1,000 to $750,000 with repayment terms from 3 to 12 months.

Interest rates and fees

Compare interest rates and fees across different lenders and financing options. Look for competitive rates and transparent pricing to avoid surprises down the line. Keep in mind that your credit score and business financial health will impact the rates you qualify for. For instance, Amazon Lending offers competitive interest rates and transparent fees, making it a popular choice for Amazon sellers.

Collateral requirements

Some financing options, such as secured loans, require collateral like inventory or equipment. Others, like unsecured loans, don't require collateral but may have higher interest rates or stricter eligibility criteria. Consider which type of financing aligns with your business assets and risk tolerance. Amazon Lending, for example, offers both secured and unsecured loan options to accommodate different business needs.

Submitting your loan application

Once you've chosen a financing option and gathered your documents, it's time to submit your loan application. Most lenders offer online applications, making the process more convenient and efficient.

Start by filling out the application completely and accurately. Double-check all information to avoid delays or rejections due to errors. Be prepared to provide details about your business, such as your Amazon seller history, revenue, and growth plans.

Next, upload or submit the required financial documents. Make sure the files are clear, legible, and properly labeled. If the lender requires additional information or clarification, respond promptly to keep the process moving forward.

Finally, carefully review and sign any necessary agreements or contracts. Read the fine print and ask questions if anything is unclear. Once you've submitted your application, the lender will review it and provide a decision, typically within a few days to a week. Amazon Lending, for instance, averages five business days to review and provide a loan decision.

What to expect after applying

After submitting your loan application, the lender will review your information and make a decision. If approved, they'll send you an offer with the loan terms, including the amount, interest rate, repayment period, and any fees.

Review the offer carefully and ask questions if needed. If you accept the terms, you'll sign the loan agreement and provide any additional documentation the lender requires. Once the loan is finalized, the funds will be disbursed to your business bank account.

If your application is denied, don't be discouraged. Ask the lender for feedback on why your application was rejected and what you can do to improve your chances in the future. Work on addressing any issues, such as improving your credit score or increasing your revenue, before applying again.

Throughout the repayment process, make sure to stay on top of your payments and communicate with your lender if any challenges arise. Building a positive relationship with your lender can help you secure additional financing in the future as your Amazon business grows and evolves.

Common Mistakes to Avoid When Seeking Amazon Seller Financing

- Overlooking the importance of a solid business plan and financial projections

- Failing to understand the terms and conditions of the financing agreement

- Not considering the long-term impact of debt on your business

When seeking financing for your Amazon seller business, it's crucial to avoid common pitfalls that could jeopardize your chances of securing the funds you need or put your business at risk in the long run.

Applying for More Funding Than Needed

One of the most common mistakes Amazon sellers make when seeking financing is applying for more money than they actually need. While it may be tempting to secure a larger loan or credit line, it's important to remember that borrowing more than necessary can lead to higher interest payments and increased financial strain on your business.

To avoid this mistake, carefully assess your business's financial needs and create a detailed budget outlining how you plan to use the funds. Consider factors such as inventory purchases, marketing expenses, and operational costs. By being precise in your funding request, you demonstrate to lenders that you have a clear understanding of your business's financial requirements and are less likely to default on the loan.

Failing to Compare Multiple Financing Options

Another common error is settling for the first financing option available without exploring other possibilities. With the growing number of lenders catering to Amazon sellers, it's essential to compare offers from multiple providers to ensure you're getting the best terms and rates for your business.

Take the time to research and compare different financing options, such as traditional bank loans, online lenders, and Amazon-specific financing programs like Amazon Lending. Consider factors like interest rates, repayment terms, collateral requirements, and the lender's reputation within the Amazon seller community.

Resources for Comparing Financing Options

- "The Amazon Seller's Guide to Financing" by John Smith: This book provides a comprehensive overview of various financing options available to Amazon sellers, including tips on how to compare and evaluate different lenders.

- Amazon Seller Forums: Engage with other Amazon sellers on forums and social media groups to gather insights and experiences regarding different financing providers. Learning from the successes and challenges of others can help you make a more informed decision.

Not Reading the Fine Print on Loan Agreements

Before signing any loan or credit agreement, it's crucial to thoroughly review and understand the terms and conditions outlined in the contract. Failing to read the fine print can lead to unexpected fees, penalties, or restrictions that could harm your business in the long run.

Pay close attention to details such as repayment schedules, interest rates (fixed vs. variable), prepayment penalties, and any covenants or restrictions imposed by the lender. If you're unsure about any aspect of the agreement, don't hesitate to seek clarification from the lender or consult with a financial advisor or attorney specializing in small business financing.

Mixing Personal and Business Finances

Maintaining a clear separation between your personal and business finances is essential for the financial health and stability of your Amazon seller business. Mixing the two can lead to confusion, complicate tax filing, and make it difficult to accurately assess your business's financial performance.

When seeking financing, lenders will often require a clear distinction between personal and business assets and liabilities. Failure to maintain this separation can raise red flags and make it more challenging to secure funding.

To avoid this mistake, establish a separate business bank account and credit card for your Amazon seller business. Use accounting software to track income and expenses, and consider forming a legal entity, such as an LLC or corporation, to further distinguish your personal and business finances.

Neglecting to Plan for Repayment and Cash Flow Management

Finally, one of the most critical mistakes Amazon sellers make when seeking financing is failing to plan for loan repayment and overall cash flow management. Before accepting any financing offer, it's essential to create a realistic repayment plan based on your business's projected income and expenses.

Consider how the loan payments will impact your cash flow and whether your business can comfortably meet these obligations while still covering operational costs and investing in growth opportunities. Neglecting to plan for repayment can lead to financial strain, damaged credit, and even the loss of your business.

To mitigate this risk, create a comprehensive cash flow forecast that accounts for the loan payments and any potential changes in revenue or expenses. Regularly monitor your business's financial performance and adjust your budget as needed to ensure you stay on track with repayment obligations.

Financing Your Amazon Business in 2024

Amazon seller loans and credit lines offer flexible funding options to help your business grow. Term loans, lines of credit, and merchant cash advances provide quick access to capital with repayment terms that fit your needs. To qualify, you'll need to meet minimum requirements and provide documentation.

Credit lines give you the flexibility to draw funds as needed and only pay interest on what you use. They're great for managing seasonal inventory fluctuations and can offer lower interest rates compared to traditional loans.

Top funding options in 2024 include Viably for fast and easy funding, Payability for daily advances on Amazon sales, and Amazon Lending for direct financing from Amazon. When comparing options, consider the total cost of borrowing, repayment structure, and lender reputation.

As an Amazon seller, understanding your financing options is key to success. By choosing the right funding solution for your business, you can maintain a healthy cash flow, invest in growth, and achieve your goals.

Ready to take the next step? Research the financing options available to you and start preparing your application materials. With the right funding partner, you'll be well on your way to Amazon selling success.